We are a Drift partner agency and we absolutely, 150% cheerlead the use of drift bots or lead bots into your marketing tech stack. Take heed, this isn’t because we help businesses like yours implement them, it’s because our own internal stats changed as we started to use a conversational marketing playbook. In one month, we increased qualification by 50% and conversations by 89%.

Don’t get me wrong, the first month's stats weren’t great. 9 conversations, and 2 qualified leads, but the figures then shot up in month two (although we did close a deal from month one).

What we haven’t yet taken advantage of is the account-based marketing feature you can include which can really change the game.

Like any technology addition, you have to let that bed down and then kick on using the first few months as a learning curve to assess performance and what is working and what isn’t.

10 reasons to use a conversational marketing playbook

It is built to complement inbound marketing

The first thing is that we’ve all started to accept that whilst the inbound marketing movement is producing leads, the qualification time that it takes getting people to download your content and start the email nurturing process extends the whole sales cycle.

The intent is the one thing that inbound marketing can’t capture in real-time unless they’re on the bottom of the funnel offer page and this is where your lead bot steps in.

In the age of chat, lead bots come into their own. Able to sit ready for the website or landing page visitor that is ready to buy or book, who needs someone or something to handle that request. Immediacy is the name of the game for both prospect and salesperson and with proven increases in closure and sales cycles, it’s a win-win for all involved.

Accelerate your lead qualification

Lead qualification is another issue in inbound marketing. Whilst we touched on it in point 1, B2B companies have seen as much as a 50% increase in lead qualification on a consistent basis. Couple this with potentially increasing opportunities by 170% and reducing your sales cycle by 63%, the figures speak for themselves.

If nothing else, please present the case studies to your boss!!

Serve premium content to your visitors

Premium content should be given away without long forms. Utilise your conversational marketing playbook and your drift lead bot correctly, and you can serve premium content mid-conversation without a form.

You can still grab an email address or phone number in a more relaxed fashion whilst angling the conversation toward speaking to or booking an appointment in your salesperson's diary.

Use keyword recognition

So your boss says, but you are creating conversations in advance of your conversation, what if our prospect asks for something different?

Simple, you add keyword recognition into your conversational marketing playbook and let the chat flow. You can customise how your lead bot handles the keywords by using contains [keyword], equals [keyword] or similar [keyword] as match points.

Using a combination of keywords and structured conversation will amplify your results.

Hybrid your form strategy

Forms are a turnoff for many people including myself. They’re accepted but not so user-friendly, even when you use smart forms.

We have seen success on our landing pages, offering both the form and the lead bot, which we tested on our conversational marketing landing page. Now we see more interaction with the chatbot than the form.

So A+B test your lead bot and forms and see which gives you the best return.

Quickly connect users with sales reps

Let’s face it, salespeople simply need conversations. Yes, they need leads ripe for speaking to, yes they need leads ripe for speaking to and I shall say it one last time, yes... They need leads ripe for speaking to.

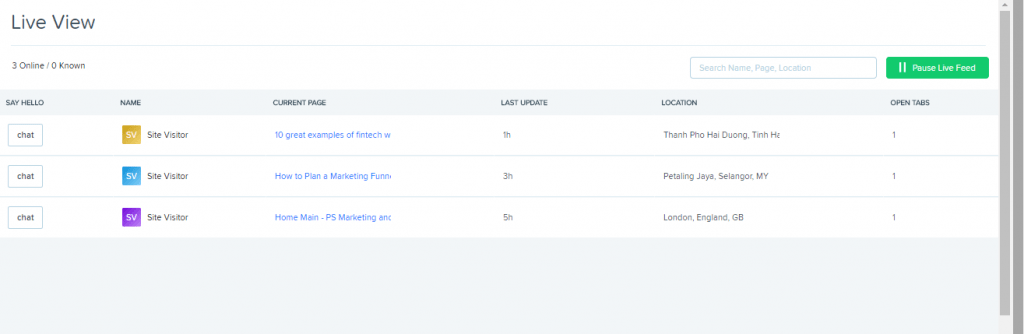

Did you know in drift, they have a live view? You can see what your onsite prospects or leads are actually doing and instigate conversations via the chatbot that isn’t in the playbook!.

Yep, you can take over a conversation the chatbot is having or instigate a fresh one if you have a prospect on a landing page. This amplifies the opportunity again to quickly connect with leads in a hot minute.

Chat app growth is huge

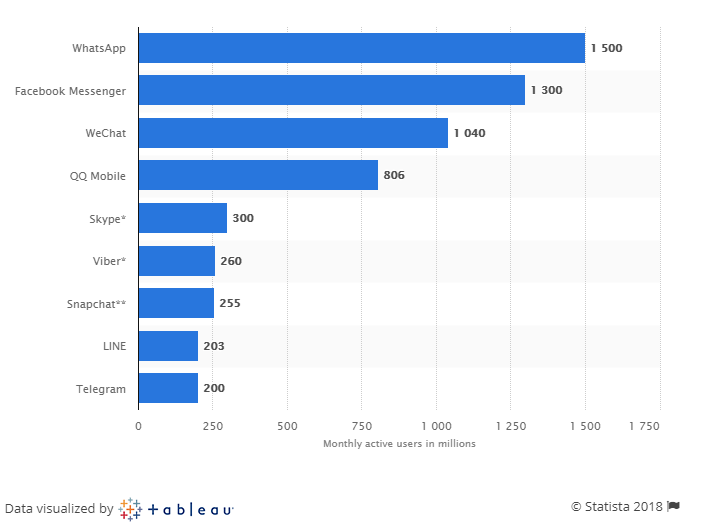

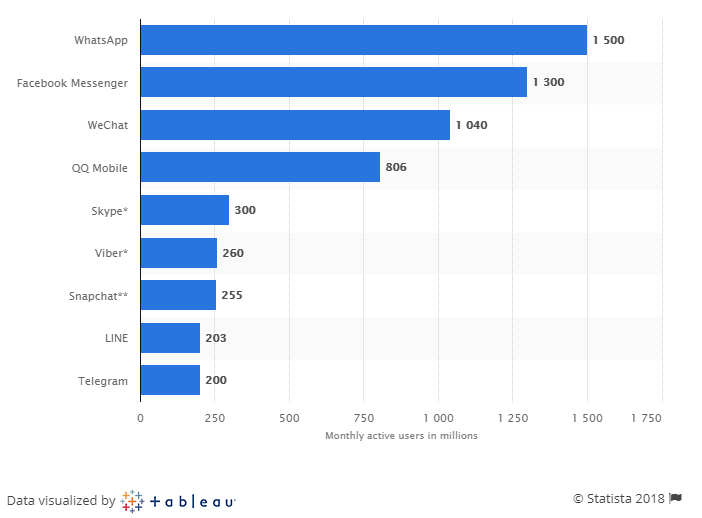

Check out the stats from July 2018 on chat app usage

Everybody is on chat so if your company isn’t, you’re in the slow lane for sure. You need to look at how this explosion can be properly harnessed for the benefit of your sales team and your profit margins.

Talk to us if you need to, that’s what we’re here for.

Be more direct and less "salesy"

Leadbots do not need to sell, although they can do if you set them up correctly. Their job is to qualify and hand the lead off, either to a live salesperson, a salesperson’s calendar or simply get the prospect's contact details.

The conversational marketing playbook should be very direct and aim to lead the prospect to where they need to get. Remember if they’re on your website, something your offer is of interest so don’t focus on that. Focus instead on asking direct questions that get to a destination that discovers what why and when. It’s that simple.

Why not test run the lead bot on our home page and follow it through like you were looking for a product we retail and see how the questions play out. Gives you an idea then how it works (please let us know at some point you were testing, or not if you need more ;))

Have multiple chatbots for different services

Like you would your funnel, create conversational marketing playbooks that are set up for each individual product or service you offer so that you maximise the opportunity to convert.

Add case studies, content links, video links and any other supportive media around that product to that playbook maximising the opportunity to accelerate qualified leads.

You still need personas, you still need segmentation and you still want to focus on developing and iterating changes for maximum benefit, that’s where a drift bot partner pays dividends.

Integrate into your account-based marketing

Finally, you must apply account-based marketing where suitable. Much like your inbound marketing platform provides reverse IP lookup. Your drift bot also tells you which large companies have been into your website and maximises the opportunities to set playbooks that recognise return visitors from specific companies, even notifying you as it happens so your sales team can strike whilst the iron is hot.

How Chatbots Improve Sales Conversion Rates on Websites

Every business focuses on lead and sales conversion rates via their company website or blogs. Many of you are adopting some kind of marketing automation process, in order to convert website visitors or prospects into leads, and nurture them through your sales pipeline using email marketing.

This takes place once they have signed up for downloadable content or a webinar on a landing page. Leads earned this way are classed as marketing qualified leads or MQL’s.

Leading marketing automation platforms enable you to build landing pages, add calls to action to your blog posts, and share your content into the social media channels your customers often operate in.

This standard format of marketing is yielding decreasing conversions as the increase in content released onto search engines accrues. Content marketing as it is commonly referred to, saw masses of blog posts released by companies trying to educate their prospects and customers, about new and current products and services. They used content for SEO gains, by targeting both long and short tail keywords within blog post titles, with a focus on search relevancy.

Amazingly, whilst all this has been happening, conversions have been reducing, sales cycles have been extending and sales personnel are complaining evermore, that the quality of lead is still mixed and not as qualified as we first think.

And to think we also lead score in the midst of all of this.

Where do they affect your profitability?

So where does this affect profitability?

We all understand that sales are a product of a simple calculation:

The number of prospects needed, to convert into qualified leads, who convert averagely into paying customers, over X number of days or weeks

Does that seem difficult to comprehend? Are you even tracking your sales cycle in this way?

If not, don’t worry as there is an answer (and you just got it) to start to do this.

However, the inbound lead generation process is often long and laborious in terms of lead nurturing and here’s why.

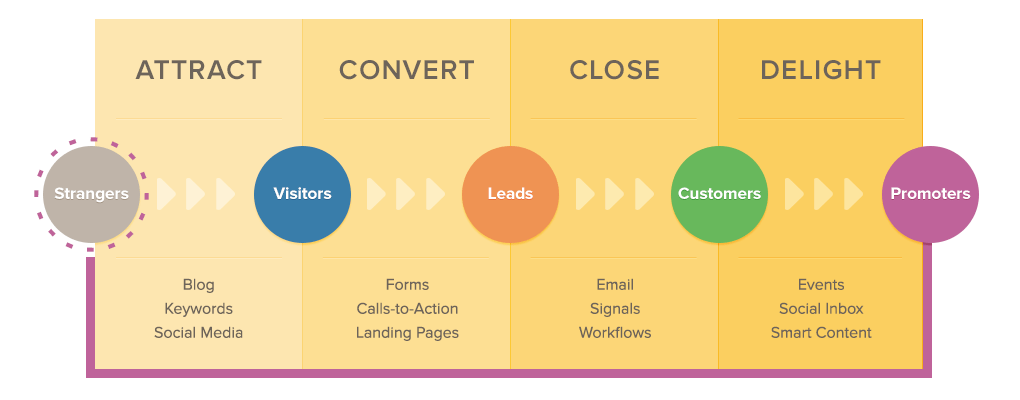

Although we talk about THE FUNNEL, ultimately that single funnel is broken down into 3 sub funnels:

-

- The Attract Funnel - content and a landing page offer to attract and get those looking for educational content about your product or service

- The Convert Funnel - content and landing page offer to convert those more educated in their search ambition or those that have been through your ATTRACT funnel

- The Close Funnel - content directly aimed at converting website prospects or those that have come through your CONVERT funnel into paying customers

This process whilst well thought out, is often focused on a period of weeks to nurture prospects, involving the timed release of nurturing emails and blog post articles, and potentially other ebooks or white papers.

It doesn’t capture intent. It still works on the premise that your prospect is uneducated, doesn’t know what they want and that you can give it to them in a timely relaxed UNOBTRUSIVE fashion.

So here’s the problem.

It doesn’t matter what stage of the funnel the prospect enters, they could be ready to buy. We are relying on what keywords we believe to be top of the funnel, or middle or bottom of the funnel to gauge the readiness of the prospect to buy.

Major mistake!

If a prospect is ready to buy and you haven’t geared that page or blog post up to support that, it’s over, you lose them. They will be off, looking for a more intuitive experience that makes their decision easy to commit to.

The power of Chatbots

Now here’s an alternative. Let’s say you’re a business doing great work in generating high levels of traffic but still seeing low conversions, then you need another option in the mix.

A leadbot.

A lead bot is a chatbot that is not focused on trying to deliver a fantastic experience through (AI) Artificial Intelligence but is designed solely to capture the intent of your website or landing page prospect in the heat of the moment.

Let’s talk turkey, it’s about closing deals, no matter what fancy strategy, marketing automation platform or paid search strategy you have. The bottom line is the bottom line and your sales staff generate that.

So equip them properly.

Unlike a chatbot, a lead bot is designed to support the sales process. It’s designed to use minimal questioning to lead a prospect down the funnel and qualify them as a chat qualified lead or a CQL.

Once you have a CQL you have a red hot buyer looking to spend some cash.

So what is a CQL and how does that help a salesperson?

Well, that’s another good question, ultimately a chat qualified lead is a prospect that has just told your lead bot that they are ready to buy, and have answered questions that back that up - that you have as a record on your dashboard.

The leadbot has a simple ambition:

-

- To welcome your prospect

- To qualify your prospect

- To close your prospect

Easy as 1,2,3!

Firstly, you welcome your website visitors and ask them how you can help. But you give them options, for example in the case of my bot PS Bot, he says “Hi and welcome, to Digital BIAS, are you looking for something specific or just browsing?”

If the visitor answers just browsing, he says “Cool, thanks for visiting I hope you enjoy the content” and is registered as a bad lead. This is a scoring mechanism.

If the visitor clicks something specific, the bot says “Great, we can help you with that” and offers 4 options “web design”, “marketing and sales”, “chatbot development” or “something else”

Note that I’m offering options, this isn’t left open to ambiguity or freedom of choice so you are already narrowing down exactly what the prospect needs help with.

Secondly once the choice has been made, the bot asks “ Are you already working with an agency like ours?” and offers options “Yes” and “No”

Again, limited options are aimed at qualifying the prospect simply and effectively.

Thirdly after the qualification process has been completed your bot closes the prospect, PS Bot says “Great, we can certainly help you with that?” and offers two further options “would you like to speak to a consultant” or “would you like to book an appointment in their diary”

And there you go, really easily chat qualified lead ready to buy.

BUT….

That’s not the ultimate service, if you have a good-sized sales team then you have additional benefits in the fact that you can have them watch these website or landing page conversations take place in real-time allowing them to jump into extremely hot leads as they are being qualified and wow, that should make a huge difference.

In fact, it does and I wrote an ebook that covers 10 huge brands using chatbots for ordering and customer service, yet none of these revealed the conversion rates. I then list 10 B2B businesses using lead bots who have listed the impact it has had on their conversions, sales and leads statistics.

You should download it as it helps you plan your leadbot too!

So there you have it, from a sales perspective you now know how do chatbots improve conversion rates on websites.

5 ways to Start Conversational Marketing

Over 1.5 billion users use WhatsApp Messenger as a means of communication, that is a fact! No wonder on that figure alone, messenger marketing and conversational marketing have exploded alongside this. More and more brands have now started conversational marketing as part of the overall strategy.

Not assured that B2B brands are operating their Facebook chat channels in a lead generation manner?

Drifts lead bot platform is the best choice for me to fulfil this conversion rate requirement. Capable of doing so much for your in-situ inbound marketing campaigns by accelerating the lead generation process. Drifts platform manages both B2B and B2C marketing and sales campaigns.

The reasons some don’t start conversational marketing

To be completely honest, I’ve had non-starter conversations about the adoption of lead bots and ways to start conversational marketing. They haven’t gotten off of the ground as soon as conversational marketing turns to chatbots. For some business development directors or sales and marketing directors, it’s not something they’ll entertain. This is a source of constant frustration as messaging apps are for more than customer support.

So here are some of the comments I’ve had over the past 3 months.

-

- “Whenever I get a bot on a website I just leave”

- “Chatbots are rubbish, they often don’t understand the questions you ask”

- “Companies try and pass the chatbot off as a person and it never works”

- “They’re really expensive to implement and take months to code”

- “They’re not suited to my industry/company”

- “Chatbots cannot close leads or make sales, lol, what are you talking about??”

- “There’s no proof chatbots, accelerate the qualification process”

- “You can’t control the conversation once the chatbot is talking so you still have to collect the information then call them back, it’s just another step in the process.”

- “Small businesses can’t use them, they’re for larger companies like….”

- “Chatbots are just for customer service and they’re often not good at that either!”

Results from real conversations April-July 2018

As you can see, there are a lot of what I call stereotypical answers. Built from a lack of education and popular bias towards technology people don’t quite understand. All of the answers are good and honest, typically reflective of the journey we’ve been on from live chat through machine learning to AI.

But some solutions don’t fit these negative criteria. It’s about education, perspective and real-time application. So below I will list 5 ways to start conversational marketing in your overall strategy.

Use it to Support Inbound Marketing

Inbound marketing is one of the most popular forms of marketing adopted around the world. The use of multiple marketing channels in one cohesive strategy is delivering dividends time and again across multiple industries.

However, inbound marketing has a long nurturing process. It is based on creating educational content targeted at an audience built around your company buyer personas. You then use a call to action to ask web visitors to download thought leadership content (ebooks, webinars) and then start automated email nurturing campaigns.

Inbound doesn’t capture intent, so if a person arrives into your content whilst searching for a solution provider and he or she has to get themselves into a nurturing workflow you can lose them. Chatbots or lead bots are there immediately to start a conversation and get a prospect into a qualified conversation in a matter of minutes. Top that off with your lead bot being able to transfer that qualified lead to a salesperson in that instant, closure rates improve and sales cycles shorten. Having a huge impact on customer experience leads to more face to face meetings.

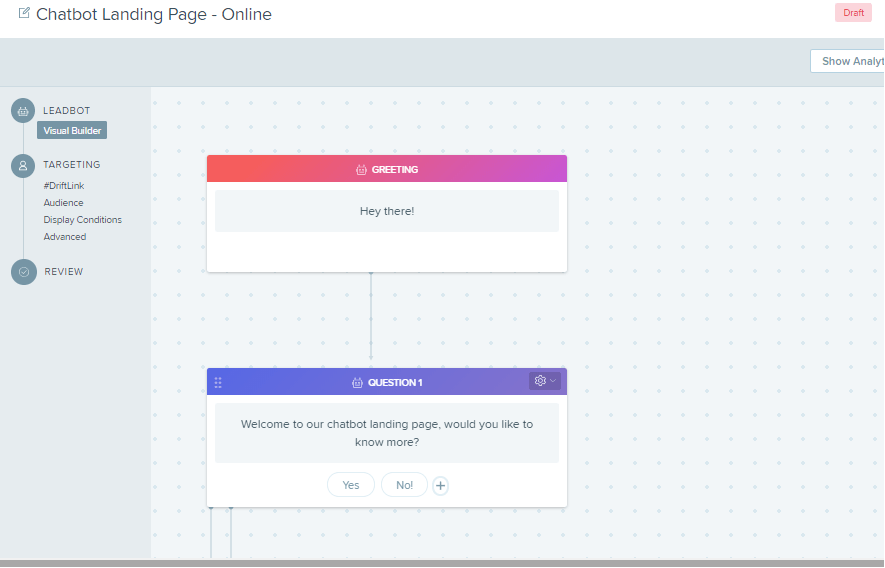

Use Drifts Leadbot Platform

To be clear we are a Drift partner, so we advocate the platform. I just wanted to be open about this now.

The benefits of this platform are superb for supporting your sales and marketing teams as the interface is simple to use and you can plan the playbook easily.

You also get a live view of website visitors that are currently on your website enabling you to reach out to initiate conversations without a chatbot, as a salesperson.

As well as having the ability to create playbooks for when you are offline and unable to enter a conversation. But also for when you are online, which would aim to get the visitor into a conversation with your sales team.

You can also include account-based marketing as the platform can tell you when companies have been on your website. This enables you to build playbooks solely for those people when they return.

And you can also integrate Drift into your sales teams calendars enabling your customers and leads to book appointments to suit.

To cap it all, Drift has an app for mobile that allows your team to follow chat conversations whilst they are on the go should they need to have full access. It’s not just for browser-based use.

The added bonus is they have a free version to get you off and started today, but feel free to speak to us for a more comprehensive consultation.

Build multiple strategic conversational marketing playbooks

To get true success out of conversational marketing, you must segment, the same as your current inbound methods. The aim is to create lead bot conversations designed to quickly qualify your website visitor and have them straight onto your sales team. This works, but not with a one size fits all strategy.

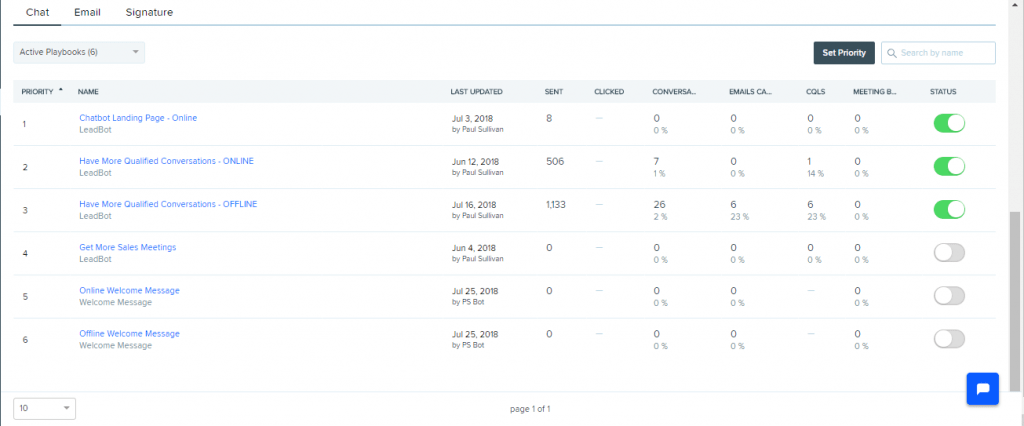

As you can see you can have multiple playbooks that you can switch on or off at any given time. The aim here is to build conversational marketing playbooks that are geared up around individual products and services so you qualify your website or landing page visitors as deeply as you see fit.

Try to brainstorm, use historical data and sales personnel experience to work out the typical questions that you are asked and build those answers into your longer playbooks and where possible try and keep your playbook to no more than 8-10 choices.

Remember, this is about being direct and quick.

Provide your help and support

Drifts platform also allows you to set up a support chatbot. This removes the need for live chat or a Facebook messenger bot and keeps your customer within your ecosystem.

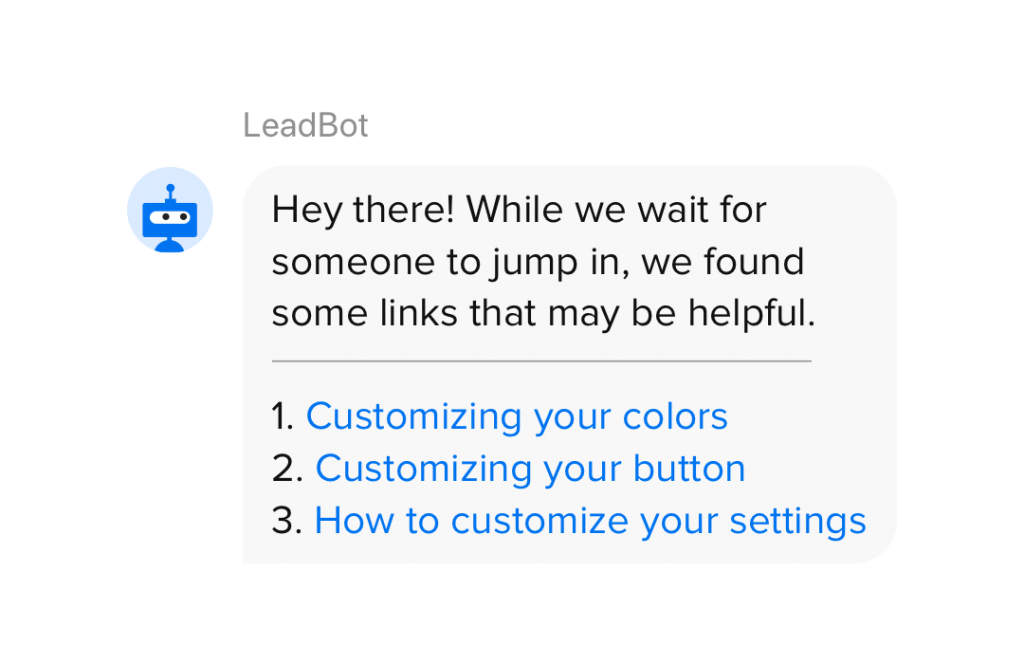

Image copyright of Drift.com

Help often enables you to allow customers who are unsure of what they need to find the right information, based on the use of keyword recognition. This functionality shouldn’t be the sole use case for support as it would also benefit a qualification playbook too!

This functionality will also allow you to feed quality website content into the conversational marketing strategy as keywords can be used to push conversion content at the prospect’s request.

So remember, help and support isn’t just customer service focused it’s also a way to allow potential customers to engage as they see fit whilst pushing for further sales or conversion opportunities…

For the SME that can’t afford a Salesperson

Let’s take a look away from the big corporates with large sales teams and get down to the smaller SME’s. The businesses where the owner may be the salesperson and the marketing person. These businesses often struggle for time to do it all and here is where a lead bot excels.

Picture this, you’re a small company, you need a salesperson but can’t quite afford one so it’s you. You need a marketing person but you can’t quite afford one so it’s you. Your choice is to do both but not fantastically well or you can add a lead bot and become great at marketing (it’s quite easy you know).

If you can spend your time generating content, social media website and landing page traffic, then you can add a lead bot. Qualify the people worth following up with and eliminate the time-wasters increasing the opportunity to grow your business.

So, as you can see, five ways to implement conversational marketing. Straight-forward reasons to add chatbots to an already functional marketing funnel and how a smaller business can employ them to help with sales instead of trying to be skilled at everything, often achieving little or no results.

If any of the reasons above are making you ask yourself if your business could look at starting conversational marketing then don’t be shy. Reach out and talk to us and we will do our best to provide you with a strategy to support your growth and accelerate your qualification numbers.

%20small.jpg)