Any SaaS CMO, Director of Marketing, Product Marketing Manager or equivalent knows the importance of competitive intelligence for their marketing strategy. But in addition to those in marketing roles, your sales leaders and their teams also need to understand where your business sits versus the competition.

This article will discuss how you can build an effective competitive intelligence strategy that will help fuel your sales and marketing efforts and align with your product-led growth initiatives for maximum success.

What is competitive intelligence?

"Competitive intelligence, sometimes called corporate intelligence, refers to the ability to gather, analyse, and use information collected on competitors, customers, and other market factors contributing to a business's competitive advantage. Competitive intelligence is important because it helps businesses understand their competitive environment and its opportunities and challenges. Businesses analyse the information to create effective and efficient business practices." Investopedia

"So how do you get started?"

How to build your discovery strategy

Discovery, research, and competitive analysis are all words associated with gathering competitive intelligence for your SaaS platform against the competition. It is a must-have or must-do process that will enable your business to correctly assess the data and make smarter decisions.

For many, tools like SEM Rush, Craft, Crunchbase, Google Alerts, Talkwalker Alerts and Feedly are great for data and analytics. Where SEM Rush excels is with its inbuilt market analysis tool, which enables you to enter a single domain and return a lot of data, which includes:

1. Market Overview

- Identify metrics for an industry of a queried domain

- See the market traffic size, industry leaders by acquisition channels, traffic trends, the share of visits, audience gender, age and interests

- Benchmark a queried domain against an industry by traffic, trends, and audience demographics

2. Estimate the competitor's market share

- Evaluate your market size and examine the key competitors

- Explore how competitors generate traffic to enhance your marketing strategy

- Uncover audience gaps to get a larger market share

3. Explore custom markets

- Discover general market trends

- Benchmark yourself against selected competitors

- Get high-level market insights for selected rivals and monitor their market dynamics

For those who don’t have the tool, click here for a free trial of the software. But to further your investigative skills, you will need some frameworks to work with, and I will provide you with three below.

How to Build a Competitive Intelligence Checklist

Next, you need to build your first checklist. Below, we list a competitive information framework to build out using Excel or Google Sheets.

You will need three fixed columns: Category, Activity, and You. In addition, you can add an extra column for each competitor you analyse. Start with a minimum of three competitors, but feel free to go to five or six. Label each column by the domain of the competitor in question.

There are six categories:

-

- Market

- Product

- Positioning

- Marketing

- Sales/Customer Success Strategy

- Company

Below we list a set of questions for each category in turn, starting with market intelligence-focused questions.

Step 1: Market intelligence questions

To kick off, let’s look at the key questions you should ask to gather the correct information. These questions aren’t exhaustive, and you can add to them, but if you haven’t done this before, they will get you started and help build your business strategy.

-

- Who are their target customers? Including segments and verticals.

- How many customers do they have? Some companies will have this published on their site; others might require a bit of digging.

- Do they have any big-ticket businesses on their client list?

- Of these, which are referenceable case study clients? They’ll shout about it if they do, so this one should be easy to find

- What countries do they operate in?

- What do their positive online reviews say? What do their negative online reviews say?

- What negatives are included in their best reviews? Consider using extracts from some in here, along with their star rating (if applicable).

- Are there any trends among their online complaints? And how have these trends changed over time?

Answering these questions will certainly help you plan your forward strategy, but they alone will not give you a competitive advantage. Assessing the strengths and weaknesses of the competition requires a multipronged approach, so the next step is to build a set of questions for your product assessment.

Step 2: Product Assessment Questions

Product assessment is a key part of your competitive intelligence research. Gathering the information that matters on the products or services of the competition requires a good set of exploratory questions. Below is a key list of questions to help you evaluate your competition.

-

- What suite of products do you and your competitors offer?

- What are the defining features of the aforementioned products?

- What are the value drivers or intended customer outcomes of the aforementioned products?

- How much do you charge versus how much do your competitors charge?

- Are they currently running any discounts or promotional offers? And for enterprise sales scenarios, are typical discounts offered?

- What are their perceived strengths?

- What are their perceived weaknesses?

- Do they offer free trials? Or pilots?

- Do they have any partnerships? If so, who with?

- Where can customers find help documents and articles?

- If you have access, what’s their user experience like? Break down the pros and cons.

So far, we have discussed market and product intelligence questions, and if you apply yourself to them, you will find the answers you need. However, there are four more areas to cover. Next, we'll look at questions that talk to positioning.

Step 3: How to explore your competitor's positioning

Understanding the competitive landscape is intrinsic to building your marketing, sales and product strategy. Collecting real-time data allows your SaaS organisation to develop a measurable and scalable roadmap for further success.

Utilise the questions below to kick off:

-

- How do they currently differentiate themselves from the rest of the market?

- What messaging do they use?

- What use cases do they have listed?

- How does the messaging change between different segments, verticals or use cases if applicable?

Only a few questions, but by answering them in full and completing the in-depth research needed to complete them, you are now building a pretty clear picture of the basis of your CI program.

Our next objective is to assess the marketing strategy of your competition. As this can cover multiple channels, we have another list of questions you can choose from as well as any of your own.

Step 4: How to assess your competitor's marketing strategy

Marketing and sales will close this part of the article, but it isn’t the end of your competitive intelligence strategy. SaaS companies not leading with the product lean heavily on their sales teams, so understanding how they attract prospective customers is essential.

So let’s look at how you can utilise competitor intelligence in marketing to help build your competitive strategy.

-

- What’s their tagline?

- How much activity is there on their marketing channels? Think about blogs, social media, webinars, eBooks, emails, podcasts, newsletters, etc.

- What types of content are in their three most important channels? I.e. thought leadership, practical how-tos, product-oriented, etc.

- What kind of marketing approach do they take? Do they target their industry as a whole? Or do they use account-based marketing (ABM)?

- What kind of topics do they talk about? And what kind of keywords do they bid on?

- Tip: A spike in previously uncovered topics could be a clue they’re bringing out something new.

- Do they get much engagement?

- How effective is their social reach? Split this by channel - i.e. Facebook, Twitter, LinkedIn, Instagram, etc.

- What are they saying in their press releases, paid campaigns, events, etc?

- Do they have any partnerships? If so, who with?

- Do they run events? And/or attend tradeshows?

- How does their organic ranking compare to yours?

- How would you describe their website’s visual identity? Have they recently had it redone?

- Do they have any cool tools, calculators, quizzes, apps, etc.?

- Do they currently or have they recently ran any competitions or campaigns?

By using this set of questions to open up the strategy of your closest competitor(s) you have laid the foundations to capitalise on your own position in the marketplace. We will now share the sales and customer success questions to wrap up this checklist.

Step 5: How to use the competition's sales and customer success strategy against them

How your business rivals manage their sales and customer success can be a key ingredient in your success. By using what's good and bad against them and sharing that information with your sales and marketing teams, you can inform your go-to-market strategy and increase customer loyalty.

Choose from any of the following questions to break it down.

-

- What does their sales process look like?

- How long does their sales cycle take?

- Do they provide things like live chatbots? If so, what’s that experience like?

- Do they have any partnerships? If so, who with?

- What types of sales assets do they use?

- You may be able to find some of this online, or if you’ve recently hired someone from a competitor, pick their brains.

- What’s their response time like for customer requests/questions?

- If it’s either really good or really bad this is usually something you can pull out from reviews/complaints.

- How do they escalate customer complaints?

Now that you have the questions to build your competitive intelligence strategy let me share a couple of other frameworks that will help you succeed.

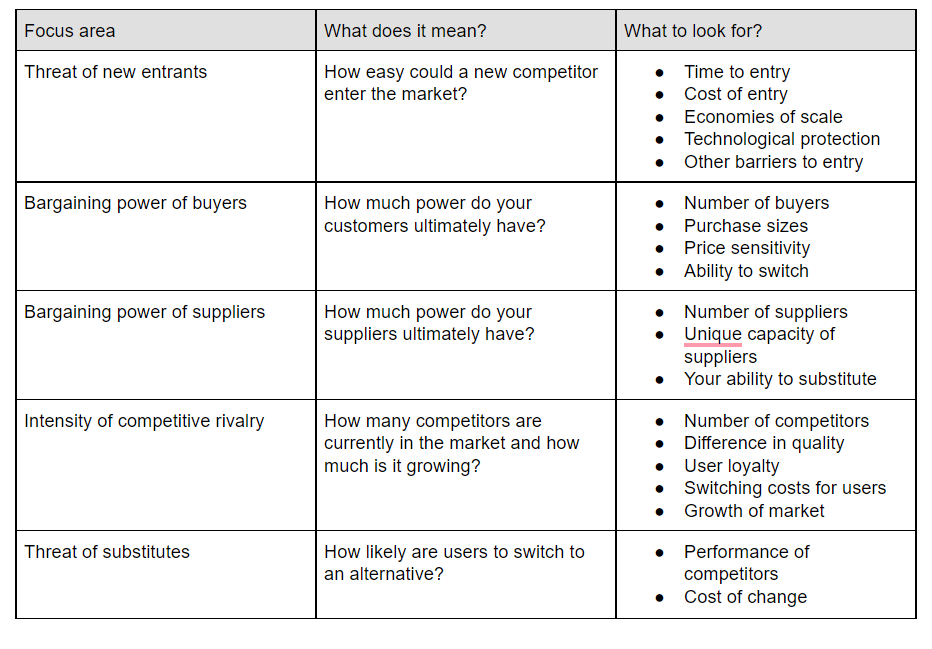

Porter's Five Forces - A Competitive Intelligence Framework

Porter's Five Forces framework is a simple and effective way to scope out your business's competitive landscape and what your product is up against.

Not in terms of product specs or features but in a broader sense of industry or segment competition, you focus on the user’s ability to switch from your product to competitors.

By using this framework in addition to the competitive intelligence checklist, you have a powerful set of tools to establish your CI strategy. But, before you sign off, we want to add one more tool to the list and then you can wrap this up.

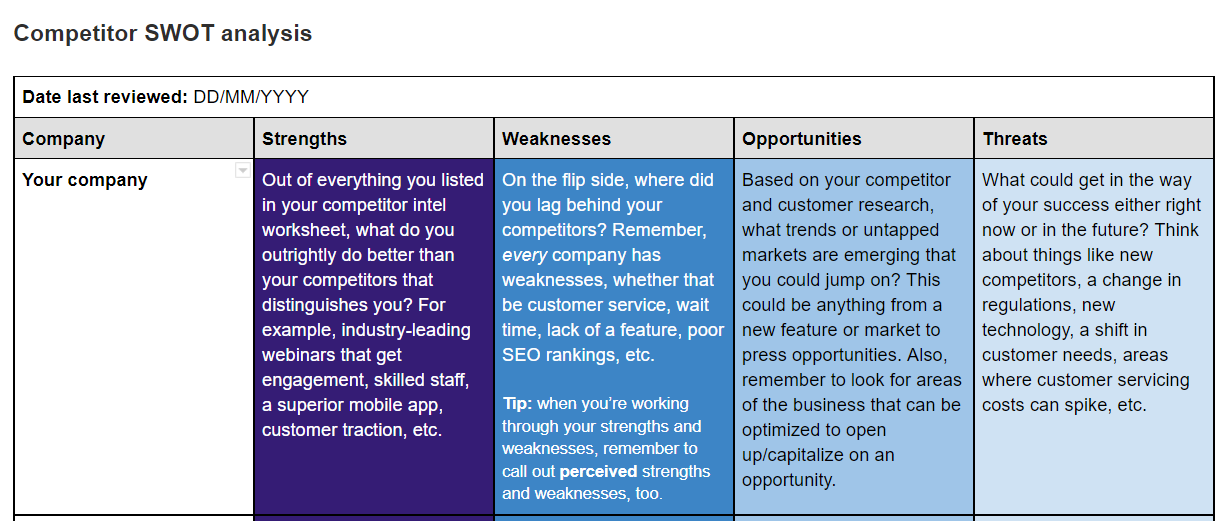

Swot Analysis. The best way to build your SWOT analysis is to use a spreadsheet. You will need five columns with the following headings: Company, Strengths, Weaknesses, Opportunities and Threats.

Once you have answered all the questions about your own business, repeat the activity for your competitors but answer from their perspective about your own business.

Out of everything you listed in your competitor intel worksheet, what do you outrightly do better than your competitors that distinguishes you? For example, industry-leading webinars that get engagement, skilled staff, a superior mobile app, customer traction, etc.

Digital BIAS are experts in product marketing as well as product-led growth. Should your SaaS organisation require help in the key growth areas of the business please reach out.